From a Freight Brokerage Startup to an Inc 5000 Powerhouse: Southern Reins’ Remarkable Growth Journey

Southern Reins Logistics isn’t just another freight brokerage—it’s a two time winner of the Inc 5000 Fastest Growing Company award that has defied all industry trends.

Founded by Jake Mathis (CEO) in 2019 in his Alpharetta, GA basement, SRL has exploded from a one-person operation to a $34 million revenue powerhouse shipping over 20,000 loads annually.

As SRL’s growth exploded, Tom Kennedy joined in December 2023 to lead the back-office operations. Tom has been instrumental in growing the SRL team size from 17 to 60+, including from just 1 person handling accounting to a lean team of 3 professionals (including Tom as their manager) managing all accounting functions today – including AP, AR, Collections, and Cash Applications.

Their meteoric rise from $8M to $34M in just four years has earned them recognition as one of the freight industry’s most innovative and fastest growing companies by Inc. 5000 in 2024 and 2025, all while maintaining a lean operational structure.

The Growth Paradox: Scaling Success Without Scaling Headcount?

With rapid growth came significant operational challenges that threatened to slow SRL’s momentum:

- Manual invoice processing consumed 60% of an accounting staff’s workday

- Weekly invoice volume skyrocketed from 120-140 to 450-550, straining human capacity

- Human error rates increased with volume as “eyes get tired” processing thousands of documents

- Limited ability to process invoices outside business hours

- The company needed to hire two additional back-office staff members to handle growth

As Jake and Tom noted:

“When you are dealing with the volume that we are, a human’s eyes get tired looking at paperwork all day. They make avoidable mistakes. We were in the process of hiring one more back-office staff when you approached us.”

What Southern Reins Looked for in an AI Solution & How Lighthouz AI Won Their Trust

For Jake and Tom, evaluating any AI solution for accounting was particularly critical because “what the program is doing directly affects the dollars that leave this company’s bank account.”

They had specific criteria and concerns:

- Hands-on validation:

“I’ve got to put my hands on this piece of technology, and I’ve got to see it and believe it, and prove to me that this is going to work.”

Lighthouz AI’s solution:

In-person demonstrations and on-site support that proved its measurable value.

- Near-perfect accuracy:

“It has to be perfect. And if there are issues, we’ve got to know about it well, well in advance.”

Lighthouz AI’s solution:

Proved more accurate than human processing at scale, with fine-tuned parameters that reduced false exceptions.

- Task-specific application:

“When I think about perfect applications of AI, it is repetitive tasks that you can clearly automate. You can’t have a robot talking to a carrier or a customer to build a relationship, but I can have a robot tied to my accounting inbox and read paperwork for me 24/7, 365 days, because that’s no human interaction.”

Lighthouz AI’s solution:

Focused specifically on automating repetitive back-office accounts payables tasks while leaving customer touches and relationship-building to humans.

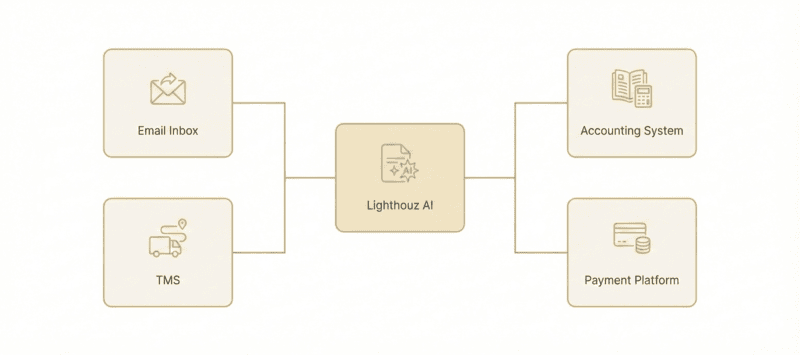

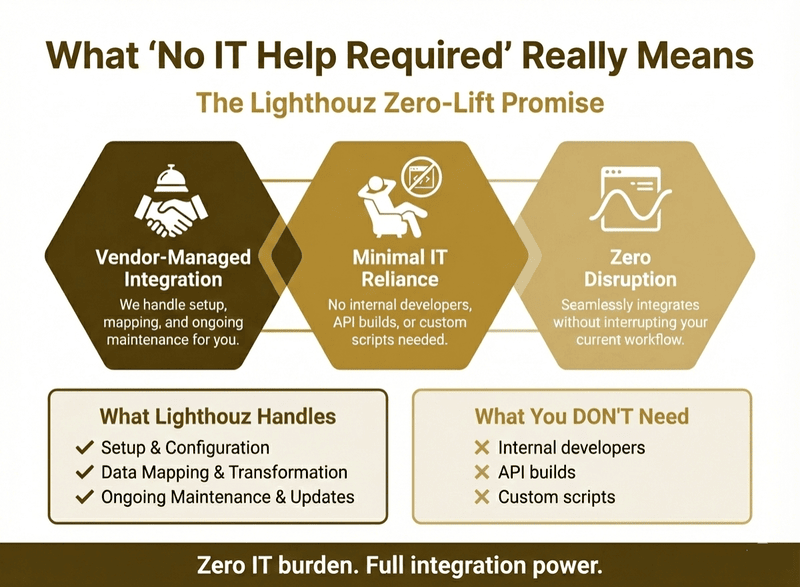

- Integration concerns:

As a lean team without dedicated IT resources, SRL needed a solution that wouldn’t require extensive technical expertise.

Lighthouz AI’s solution:

Tom noted, “Another thing that I think sets Lighthouse apart is how white glove the implementation and onboarding process was. It made it really easy for us, and the changes that we’ve requested along the way have been addressed in real time.”

- Training time:

SRL couldn’t afford any disruption to their daily operations.

Lighthouz AI’s solution:

After an initial 3-month adjustment period, the system became reliable and trusted by month six.

The Turning Point: From AI Skeptics to Automation Advocates

Despite being inundated with AI solutions, Jake was initially skeptical:

“I’m getting calls every single day, hundreds a week, everybody wants to sell me AI.”

— Jake Mathis, Founder, Southern Reins Logistics

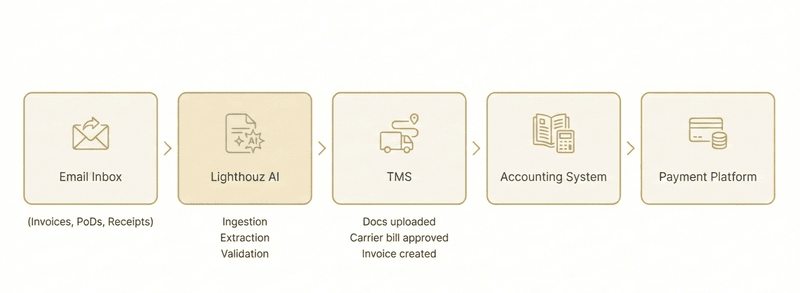

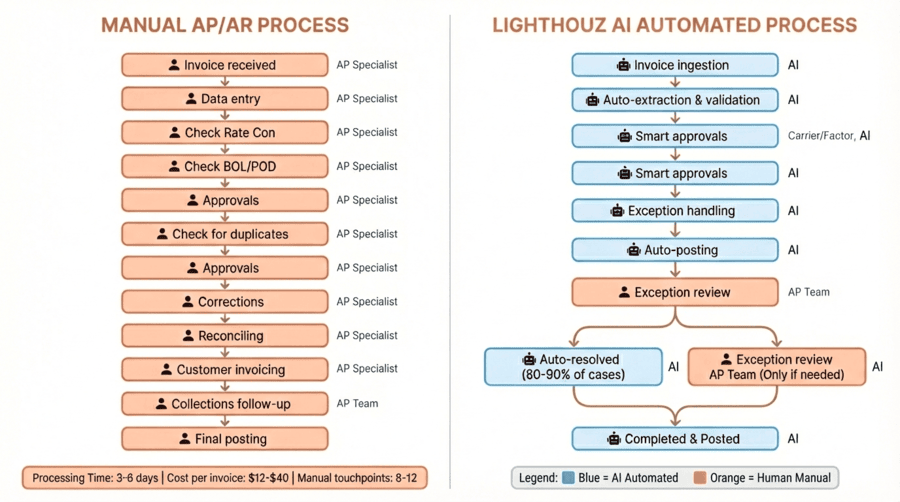

After a rigorous evaluation process, Southern Reins adopted Lighthouz AI to automate their back-office processes, particularly:

- Carrier bill audits and validations

- Carrier payment approval workflows (processing over $500,000 weekly and rapidly increasing)

- Document processing and data entry

- Exception handling for the invoices requiring human intervention

The implementation journey included:

- A quick integration process with SRL’s TMS system and AP email inbox

- A 3-6 month adjustment period where the system “learned” their business

- Customization of audit parameters to reduce false exceptions

The Results: 40% Cost Savings While Increasing Revenue by 50%

After implementing Lighthouz AI, Southern Reins achieved remarkable operational and financial improvements:

Financial Metrics That Matter

- DSO Reduction: 37.60 → 32.78 days

Lighthouz helped SRL collect customer payments faster, reducing how long cash stayed tied up.

- AR Payment Cycles: 40.81 → 35.66 days

Lighthouz shortened the time it took customers to pay, improving cash flow reliability.

- Invoicing Speed: 4.85 → 3.11 days

Lighthouz enabled SRL to send invoices sooner, so payments started sooner.

- AP Approvals: 3.48 → 2.89 days

Lighthouz sped up carrier payment approvals, keeping operations smooth and partners paid on time.

Operational Excellence

- Eliminated the need to hire 2 additional back-office staff (40% reduction in team size)

- Maintained efficient operations while growing 47% in 2025

- Increased invoice processing capacity from 120-140 to 450-550 weekly with the same team size

- Achieved 90-95% automation of “clean” invoices

- Freed up accounting staff to focus on invoicing faster, exceptions handling, and collections

Tom Kennedy emphasized the impact:

“We were on the cusp of hiring somebody for that exact role when Lighthouz approached us… but now even after growing 40% in 2025, the next hire I would consider wouldn’t be for AP, it wouldn’t be on carrier invoicing. We don’t feel any sort of stress there anymore.”

These changes improved cash flow predictability, reduced disputes, and allowed the team to scale operations without hiring additional staff.

Southern Reins Logistics’ Secret Sauce: Technology + Human Relationships

Jake explained their winning philosophy:

“Freight is a relationship business. There is nothing more to this business than having really strong relationships. Everything else is just background noise that we can ignore. With the right technology, we can stay lean, be really productive and efficient. If I’m being honest with you, the technology and the AI powered behind what you guys are doing is more accurate than what a human being can do.”

Tom added:

“We’ve been able to focus on sales, marketing, and customer service by staying lean in the back office & using the freed up resources in the front office. And Lighthouz AI has been instrumental for that.”

Southern Reins Logistics now operates a highly efficient, technology-enabled back office that supports their rapid growth without proportional headcount increases.

With Lighthouz AI, they’ve maintained their relationship-focused approach while eliminating manual bottlenecks, positioning themselves for continued expansion in the competitive freight brokerage market.

Ready to transform your brokerage back-office operations like Southern Reins Logistics?

Book a demo to learn how Lighthouz AI can streamline carrier bill audits and AP processes, improve cash flow metrics, and support growth without adding headcount – request a demo today.